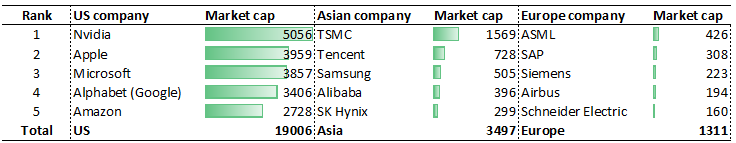

The combined market capitalization (the total value of outstanding shares) of the top 5 European tech companies, perhaps “Medium Tech” is a better term, amounts to less than half of the market capitalization of even the smallest top 5 US Big Tech company. What went wrong? Why does Europe lack Big Tech companies?

Introduction

To begin with, what is Big Tech? Big Tech, also referred to as the tech giants or tech titans, is a collective term for the largest and most influential technology companies in the world. Generally this includes the 5 big American companies (Apple, Microsoft, Alphabet (Google), Amazon and Meta (Facebook)), but usually also the Chinese Tencent and Alibaba.

I would like to add that these are companies with a market capitalization of at least dozens of billions, if not hundreds of billions, of Euros. The companies that come to mind immediately are Amazon, Google, Microsoft, and Apple. Some Chinese companies, such as Alibaba and Tencent, also fit very much into this category. Below is a very revealing overview of the market capitalizations, in billions of dollars, of the biggest tech companies, in the US, Europe, and China.

The fifth-largest US Big Tech company, Amazon, has double the market capitalization of Europe’s entire top 5. The largest Asian company is also bigger than the European top 5 combined.

Market cap data source: https://companiesmarketcap.com/ (date: 3-11-2025)

Clearly, Europe is less able to grow its tech companies to a scale that matches the US and, to a lesser extent, the biggest Asian companies. Looking at the European top 5, this also includes comparatively old companies like Siemens, Airbus and Schneider Electric, which produce quite different tech than the full US top 5.

The US Big Tech Top 5 focuses on cloud computing, software and operating systems, digital marketplace (& subscriptions), hardware & smart devices and AI. There is no European counterpart of this on any significant scale. Asia, particularly China, does have some counterparts such as Tencent and Alibaba.

So why does this type of Big Tech not exist in Europe?

There are multiple reasons for this. First of all, Europe is a highly fragmented market, particularly compared to the US and China. There are 44-50 countries in Europe and 27 languages indigenous to Europe. Of course the European Union is attempting to create one single market with some success, but there are still many barriers.

For example, a company expanding from France to Germany must comply with two distinct corporate laws, tax systems and employment regulations. This is of course also a problem for US and Chinese Big Tech, but with the scale Big Tech has it is much easier to navigate this complexity compared to a start-up in Europe. US and Chinese companies can first become large enough in their home country, before they have to tackle the European legislative maze.

Secondly, Europe has a risk-averse financing culture. As explained in this article, the biggest US and Chinese companies raised an average $7.3 billion, whereas the biggest European companies raised $1.6 billion. Furthermore, the share of global venture capital funds raised in the EU is only 5%, compared to 52% in the US and 40% in China.

Another proof point is that between 2015 and 2024 American companies acquired about 4 times more startups (1785 deals, $477B value), including many European startups, compared to European companies (471 deals, $117.5B value). Or how about the fact that 30% of our so-called unicorns (companies with market cap > €1 billion) relocated outside of Europe between 2008 and 2021? Or that only 8% of global scale-ups are located in Europe?

Lastly, the European Union is leading in terms of protecting consumer rights, with GDPR (data privacy law) as well as strict product safety, refunds and warranty laws. Even more so, there are strong laws coming into existence to regulate Big Tech further (the Digital Market Act) as well as laws to regulate the uncontrolled rise of AI with the EU AI Act.

All of this is fantastic for consumers, and the world would be better off if the whole world would implement most of it. However, it doesn’t make it very appealing for Big Tech to settle and stay in Europe and the rate of growth will be lower while navigating this jungle of rules.

If Europe is to compete in the Big Tech arena, a better balance is needed between these regulations and enabling the scaling of European startups. Note that I am using Europe here fairly loosely but I generally mean the sphere of influence of the EU, including EU candidate countries (like Albania and Serbia), as well Switzerland, the UK and Norway.

I realize these were a lot of numbers, proving that European start-ups and small business are really struggling with scaling. Now let’s look at another angle: Europeans spend over $300 billion on US Big Tech, which is about ~14-20% of total US Big Tech revenue, depending on which firms you include. What if we would spend that money on European companies – how fast could we get on par with US Big Tech then?

Is this really a problem?

That’s the million-Euro question and the answer is a big “yes”. There are some worrying trends in the world, which lead to it being increasingly important for Europe to have its own tech. I wrote more on that in this article. Although Big Tech has undeniably brought us many nice things, many are simple quality of life improvements we can do without.

However, particularly with the rise of cloud computing, Big Tech became embedded in the fabric of our daily life – governments and most companies run on Office 365, most servers run on AWS or Microsoft Azure, or the Alibaba Cloud. If the US or China decided to switch off those services, Europe would face a major problem. Governments will mostly malfunction, just like hospitals, universities, utility companies and most of the industry. They will likely recover, but it will take weeks if not months to be fully up and running again.

So what is Europe doing now?

Europe must create solid alternatives to the most important American Big Tech. Cloud computing – a proper competitor for Microsoft Azure and AWS, should be first on that list, with many more to follow. This has been recognized and some initiatives, like Gaia-X, are running. However, Gaia-X is not yet in a state where it offers any significant competition. I just checked if I could buy computing power at Gaia-X. This isn’t possible for two reasons: firstly, Gaia-X is not a cloud provider a such, but a standards and certification body. Secondly, it’s not straightforward to find out where to buy Gaia-X certified compute power. I spent 20 minutes to find it and didn’t succeed. With Amazon or Azure you will probably have your first virtual server running in that time. This is of course anecdotal, but it does give a view on what state this initiative is in, although I sincerely hope this will improve.

Promising is also the Eurostack initiative which intends to heavily improve European digital sovereignty by building a technology stack covering cloud, AI, identity, payments and data sharing. At this moment, the Eurostack is an influential strategic proposal, but nothing concrete has been delivered yet. Even though the EU standards are great, more is needed to create a real alternative to the US Big Tech behemoths and that is not happening yet in Europe. The alternatives will have to reach (close to) feature and price parity and that is very difficult without the immense scale of the behemoths.

The EU is taking this seriously as well – particularly as a result of the Draghi report on EU competitiveness, which outlines quite a gloomy future if the EU doesn’t act. Partially triggered by that report, the EU is acting now in quite some areas related to innovation and scaling start-ups. First of all, with InvestAI which is supposed to mobilize huge funding in AI (€200 billion) over 5 years. Secondly, a ScaleUp fund of about €5 billion has been launched as well to keep EU unicorns in the EU. Lastly, the Draghi report also triggered the proposal to create a so-called 28th regime. This is an optional EU-wide legal framework providing startups and scaleups a harmonized set of rules: covering corporate, insolvency, labor, and tax laws. This can be choosen instead of national laws, enabling much easier cross-border operations. Even though it’s optional, if implemented well, this would be a major step towards a single market.

Unlocking the promise of European tech

It is, without doubt, a big problem that Europe lacks good, widely known, alternatives to US and Chinese Big Tech. If Europe solely walks the path of (de)regulation to stimulate innovation and scaling, real results will take many years, if not decades. European consumers also need to change their mindset and choose European alternatives where they exist and are adequate. European solutions, which implement all of the European regulation and strong customer protection could hold quite a unique position globally. These could appeal not only to European consumers but even to users in the US, who increasingly value data security and ethical AI. Europe is in a unique position to build a tech ecosystem that prioritizes privacy, security and sustainability and should find a way to capitalize on that.

The current situation is not great, but there is light on the horizon – Europe does have some small to medium sized enterprises that offer promising solutions. And I believe some are ready to replace Big Tech for many consumers, which I’ll explore further in my next articles.

Leave a Reply